- All casinos accepting cryptocurrencies

- Are all cryptocurrencies the same

- Are all cryptocurrencies mined

Are all cryptocurrencies the same

“Because cryptocurrencies are volatile, they are not yet used much to purchase goods and services. But that is changing as PayPal, Square and other money service businesses make digital asset services broadly available to vendors and retail customers,” notes Patrick Daugherty, senior partner of Foley & Lardner and lead of the firm’s blockchain task force https://casino-888.org/en/bonus/.

The Ethereum blockchain is not likely to be hacked either—again, the attackers would need to control more than half of the blockchain’s staked ether. As of September 2024, over 33.8 million ETH has been staked by more than one million validators. An attacker or a group would need to own over 17 million ETH, and be randomly selected to validate blocks enough times to get their blocks implemented.

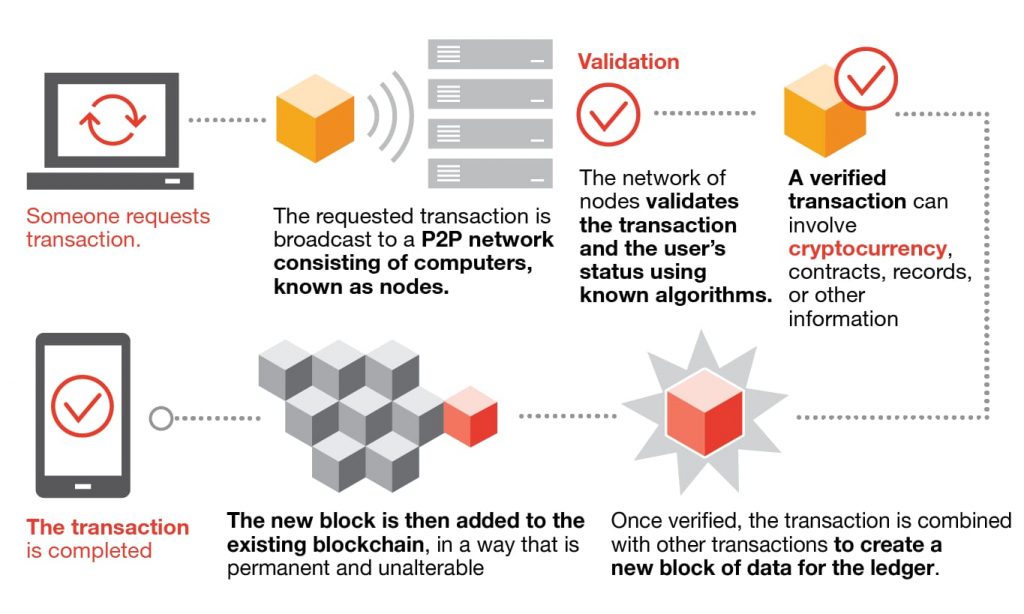

A blockchain is a decentralized ledger of all transactions across a peer-to-peer network. Using this technology, participants can confirm transactions without a need for a central clearing authority. Potential applications can include enterprise blockchain applications, sustainability, tokenization, fund transfers, supply chain tracking and many other areas.

Cryptocurrencies and blockchain technology are often regarded as the same thing. This makes it seem like a cryptocurrency cannot exist without an underlying blockchain technology. But is this really the case?

All casinos accepting cryptocurrencies

This crypto casino takes an interesting approach to bonuses. Instead of the usual match deposit you’ll find a variety of options such as Daily Races and a Weekly Raffle opening up upon registration. You won’t find a minimum deposit or withdrawal requirement, which is a common approach taken by crypto casinos.

FortuneJack Casino is a reputable and trusted online casino that offers a wide range of games, generous bonuses and promotions, and secure payment options. It is a great choice for players looking for a reliable and enjoyable online gambling experience that combines sports betting and regular casino gaming. Moreover, the bonuses and promotions are great, which only further cements its place among the best Bitcoin casinos.

FortuneJack is a well-established online casino that has been in operation since 2014. It is owned and operated by Nexus Group Enterprises Casinos, a company based and licensed in Curacao. The casino is known for its wide range of games, including slots, table games, and live dealer games. Moreover, the platform features a comprehensive Sports betting section.

David is a passionate content creator with extensive experience in writing about online casinos. With a solid background in the gambling industry, he provides in-depth analyses and reliable evaluations of various online casinos, helping readers make informed decisions. Beyond his professional expertise, David is keenly interested in the evolving digital entertainment landscape and enjoys staying updated with the latest gaming technology trends. This blend of professional knowledge and personal interest ensures that his reviews are informative and engaging.

Crypto casinos offer fast payouts, better privacy, and bigger bonuses, making them a great choice for players who want flexibility and the option to use digital currencies. On the other hand, FIAT casinos offer a familiar experience with traditional payment methods, are regulated, and are easily accessible to players worldwide.

Are all cryptocurrencies the same

The lack of decentralization in digital currencies creates issues with their transparency. The major difference between digital currency and cryptocurrency suggests that the details of digital currencies are under the control of the service providers, senders, receivers, and banking authorities. Therefore, conflicts in the domain of digital currencies require the intervention of law and bureaucracy.

But it’s not just exchanges either, tokens also made way for more complex platforms supporting swapping, lending, and even crypto derivatives. You can even buy tokenized real-world assets on the blockchain today. Yes–that’s right. There are crypto tokens that represent precious real-world assets such as gold or silver too. These types of tokens are just the tip of the iceberg.

One of the most prominent highlights in any digital currency vs cryptocurrency debate is decentralization. It refers to the element of control over the value of the assets that you own. Digital currencies, such as CBDCs, are centralized and regulated. It implies that the government of a country, central banks, and other financial intermediaries control digital currencies. For example, the government or central bank establishes the value of digital currencies. Digital currencies are also at risk of collapse during changes in the political status of a country.

Before we proceed to the the nuances of various cryptocurrencies, let’s first establish a basic understanding of what they are. At their core, cryptocurrencies are digital or virtual currencies that utilize cryptography for security and operate on decentralized networks based on blockchain technology.

The lack of decentralization in digital currencies creates issues with their transparency. The major difference between digital currency and cryptocurrency suggests that the details of digital currencies are under the control of the service providers, senders, receivers, and banking authorities. Therefore, conflicts in the domain of digital currencies require the intervention of law and bureaucracy.

But it’s not just exchanges either, tokens also made way for more complex platforms supporting swapping, lending, and even crypto derivatives. You can even buy tokenized real-world assets on the blockchain today. Yes–that’s right. There are crypto tokens that represent precious real-world assets such as gold or silver too. These types of tokens are just the tip of the iceberg.

Are all cryptocurrencies mined

Mining can be highly profitable, but only when participants have carefully analyzed the costs. New entrants can expect to encounter “high fixed costs, technological complexity, and intense competition,” all of which are significant barriers to overcome, according to Peter Earle, a senior economist at the American Institute for Economic Research.

Mining pools are groups of miners who pool their resources (hash power) to increase their chances of winning block rewards. When the pool successfully finds a block, the miners in the pool share the reward according to the amount of work they each contributed.

A few months ago we attempted to tackle this lack of knowledge by examining the basics of cryptocurrencies, blockchain technology, and more recently cryptocurrency mining. Today, we’ll expand on this latter point by taking a closer look at the side-by-side differences of “mined” cryptocurrencies versus non-mined ones. And, as always, we’ll do so in plain English, without all the technical jargon.

Dogecoin was originally created as a joke in 2013 but has since become a widely recognized cryptocurrency. It uses the Scrypt algorithm, making it similar to Litecoin, and can be mined using ASICs and GPUs.

New bitcoins are added to the Bitcoin supply approximately every 10 minutes, which is the average amount of time that it takes to create a new block on the Bitcoin blockchain. By design, the number of bitcoins minted per block is reduced by 50% after every 210,000 blocks, or about once every four years.